The Board of Directors is currently comprised of eight individuals. Members have operated at senior executive levels at some of the largest major consumer brand FMCG companies in the world and at leading logistics and technology companies, providing them deep insight into the needs of pallet users.

ABOUT RM2

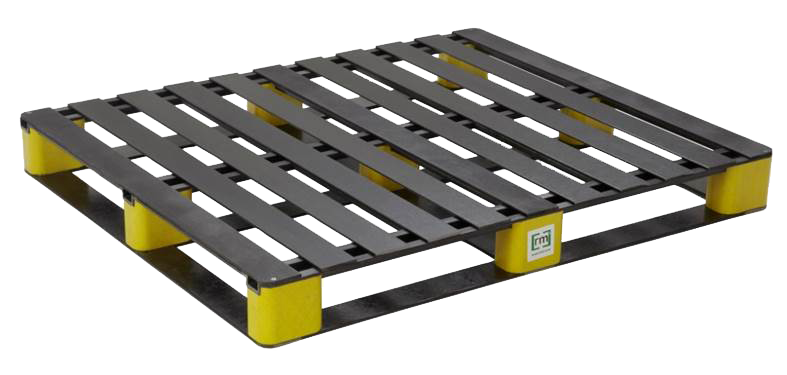

RM2 launched the smart pallet revolution by embedding autonomous IoT sensor technology in its logistically-optimized, hygienic BLOCKPal™ composite pallets. IoT sensor data are transmitted to the cloud via the LTE-M network, making visible the pallet’s location and condition both indoors and in transit without requiring any additional hardware or IT development. RM2 ELIoT®, the Company’s cloud-based supply chain intelligence platform, captures and contextualizes location, temperature, shock, and event data, giving customers end-to-end supply chain visibility and clear, actionable insights in real time. RM2 issues, retrieves, and sanitizes more than 1.5 million of its hygienic IoT pallets annually through a nationwide network of over 30 service facilities in a cost-effective, scalable, and environmentally sustainable pallet pooling system.

1,500,000

30

60,000,000

BOARD OF DIRECTORS

Prior to joining RM2, Mr. Mazula served as Chief Commercial Officer at PRIMUS Technologies and as a Senior Vice President of Xerox, where he led growth strategy and global productivity and cost competitiveness initiatives, respectively. Prior to these roles, Kevin served as Vice President of Global Business Units at Jabil, where he led the company’s Telecom and Networking business. He also founded Jabil’s Energy Management business, establishing the company’s leadership position in Smart Metering and the Smart Grid. Mr. Mazula began his career at General Electric, holding leadership roles in engineering, operations, and program management.

Mr. Mazula is a member of the Executive Board of the Reusable Packaging Association, a non-profit trade organization focused on achieving sustainability through the reuse of packaging systems. He graduated with honors from the Wharton School where he earned his MBA in International Finance. As a Lauder Fellow, he was also awarded a MA in International Studies from the University of Pennsylvania. Mr. Mazula earned his undergraduate degree in Mechanical Engineering from the Massachusetts Institute of Technology.

Prior to founding OEP, Mr. Cashin was with Citigroup Venture Capital from 1980-2000 and served as President from 1994-2000. Mr. Cashin is a Trustee of the American University in Cairo, Boys Club of New York, Brooklyn Museum, Central Park Conservancy, Jazz at Lincoln Center, National Rowing Foundation, and Newport Festivals Foundation. Mr. Cashin is active in inner-city educational initiatives, Row New York’s efforts to build a Norman Foster designed boathouse on the Harlem River, and Harvard fundraising where he has served as Co-Chairman of his Harvard class for over 40 years. In 1976 and 1980, Mr. Cashin was a member of the U.S. Olympic Rowing Teams and was a world champion in 1974. Mr. Cashin is the son of a Foreign Service Officer and grew up in Libya, Ethiopia, Ghana, Indonesia, and Pakistan. He attended Harvard University and graduated in 1975 with a degree in East Asian Studies. Following a one-year fellowship at Trinity College, Cambridge in 1976, he worked at Jardine Matheson in Hong Kong. In 1980, Mr. Cashin completed his M.B.A. at Harvard Business School.

EXECUTIVE TEAM

Prior to joining RM2, Mr. Mazula served as Chief Commercial Officer at PRIMUS Technologies and as a Senior Vice President of Xerox, where he led growth strategy and global productivity and cost competitiveness initiatives, respectively. Prior to these roles, Kevin served as Vice President of Global Business Units at Jabil, where he led the company’s Telecom and Networking business. He also founded Jabil’s Energy Management business, establishing the company’s leadership position in Smart Metering and the Smart Grid. Mr. Mazula began his career at General Electric, holding leadership roles in engineering, operations, and program management.

Mr. Mazula is a member of the Executive Board of the Reusable Packaging Association, a non-profit trade organization focused on achieving sustainability through the reuse of packaging systems. He graduated with honors from the Wharton School where he earned his MBA in International Finance. As a Lauder Fellow, he was also awarded a MA in International Studies from the University of Pennsylvania. Mr. Mazula earned his undergraduate degree in Mechanical Engineering from the Massachusetts Institute of Technology.

Prior to joining RM2, Mr. Cochran was the president of Pono Kokua consulting which worked with private equity on acquisitions and creating wealth in those acquisitions.

Mr. Cochran has engineering degrees from the Missouri University of Science and Technology and received his MBA from Arizona State University’s WP Carey School of Business. He holds certificates in Negotiations and Management from Harvard University’s Schools of Law and Business.

Mr. Staffel began his finance and accounting career at General Dynamics within the aerospace division performing audit, price/cost analysis of major avionics and subsystem contracts. He is a member of the American Institute of Certified Public Accountants, Texas Society of Certified Public Accountants and has held leadership roles including Past President of Financial Executives International Fort Worth Chapter and Past President of Association for Financial Professionals Dallas Chapter. Mr. Staffel holds an MBA in Finance from Texas Christian University and a BA in Economics from The University of Colorado at Boulder. He is a Certified Public Accountant, Certified Treasury Professional and Chartered Global Management Accountant.

COMPANY HISTORY

RM2 was founded in 2007 to develop and bring to market a revolutionary composite pallet and supply chain service platform. Since its inception, the Company has invested more than US $60 million in R&D for pallet manufacturing technology and design.

RM2 USA, Inc., Ownership Statement

RM2 owns and operates a pool of high-quality composite pallets with embedded IoT trackers. The pallets are available for rent from depots throughout the United States and Canada. RM2 pallets are black with yellow and red legs and are clearly labelled as RM2 pallets. RM2 retains ownership of its pallets at all times and never sells pallets with IoT trackers. RM2 pallets must not be bought, sold, traded, exchanged, damaged or destroyed under any circumstances. Stocks of RM2 pallets and pallets under load may be kept and used only by authorized representatives, customers and other users. If stray RM2 pallets arrive at your facility, please call 1-844-779-9858 or email info@rm2.com immediately to arrange transportation and return of these pallets to an authorized RM2 depot. RM2 actively tracks and collects errant pallets to return them to its operating pools.